For more than a decade, Silicon Valley venture capitalists have poured enormous sums of money into newfangled technology companies seeking to disrupt, and even supplant, the traditional financial system and sidestep its burdensome regulations. At the same time, the Consumer Financial Protection Bureau has policed that effort, going after such businesses for deceiving, overcharging or otherwise taking advantage of their customers by enacting rules, filing lawsuits and shutting down the worst offenders. This cat-and-mouse game has long rankled tech leaders, but it has especially irritated Marc Andreessen, one of America’s most well-known investors and an outsize figure in the so-called...

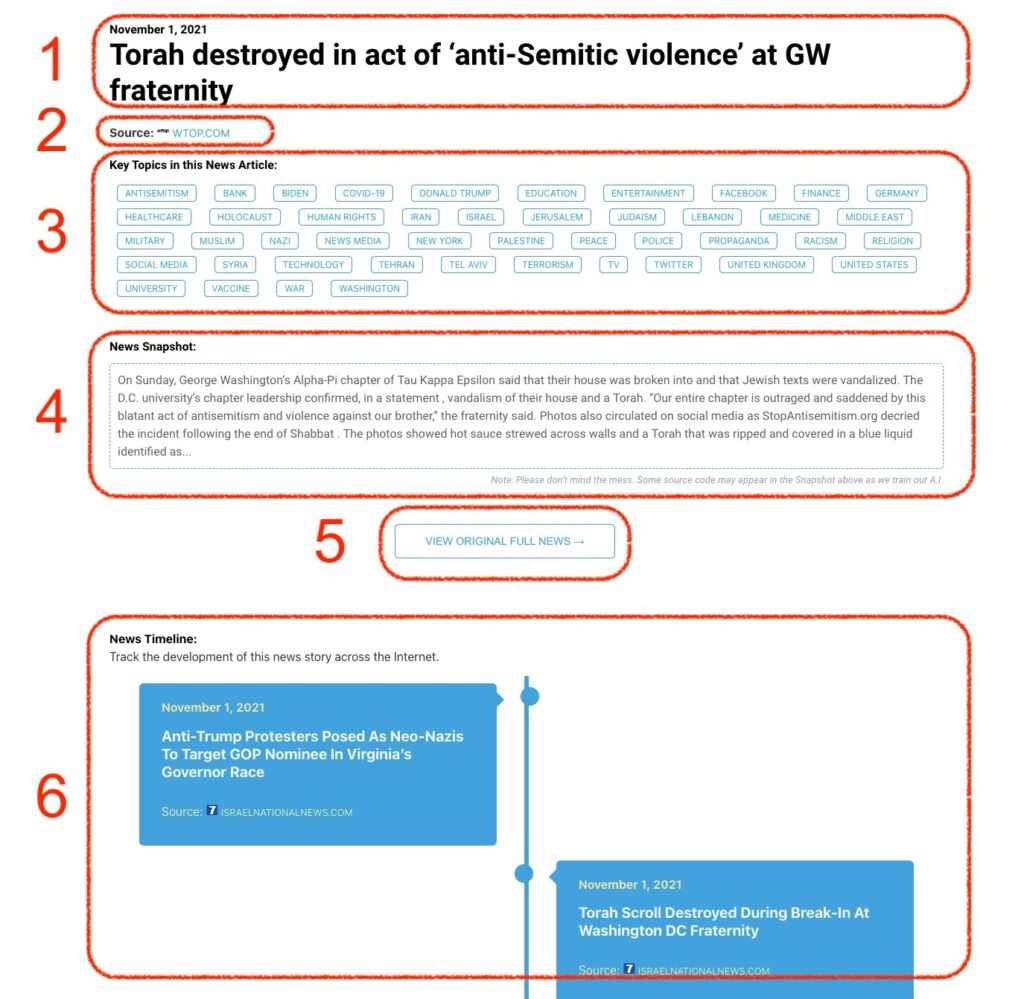

Monitoring Antisemitism Intel